Digi-Capital, an investment bank for mobile apps and games, has just

published its Mobile Apps Investment Review Q1 2014 (

www.digi-capital.com/reports). Commenting on the Review, DigiCapital Managing Director Tim Merel

said:

“Everyone knows that mobile apps are hot, and that games have taken the

lion’s share of revenue so far. We think the balance is going to change, with other

app categories using new approaches to win. We’re already seeing SaaS-like App

as a Service models emerging, and we can’t wait to see what happens next.

We forecast that mobile apps could reach >$70B revenue globally, with

non-games apps to double revenue share from 26% to 51% by 2017 (61.3% CAGR 13-17F).

Dramatic mobile app usage growth is disrupting incumbents, with mobile

usage having grown 5x in 4 years to ~20% of media consumption last year (50%

CAGR 09-13).

Mobile apps investment has doubled across categories since Q3 2013, with

~$10B invested in the last 12 months. There are clear hotspots in specific app categories,

with an increased level of investment across the board.

Mobile apps M&A hit a record >$35B in the last 12 months (>$16B excluding Facebook/WhatsApp),

continuing a 3 year strong growth trend even without that spectacular

transaction. At over $7B (excluding FB/WhatsApp), Q1 2014 M&A was >2x Q1

2013 M&A. Including FB/WhatsApp, Q1 2014 M&A was >7x Q1 2013.

M&A has been more concentrated around

specific app categories than investments, which is not surprising given the

early stage of the apps market.

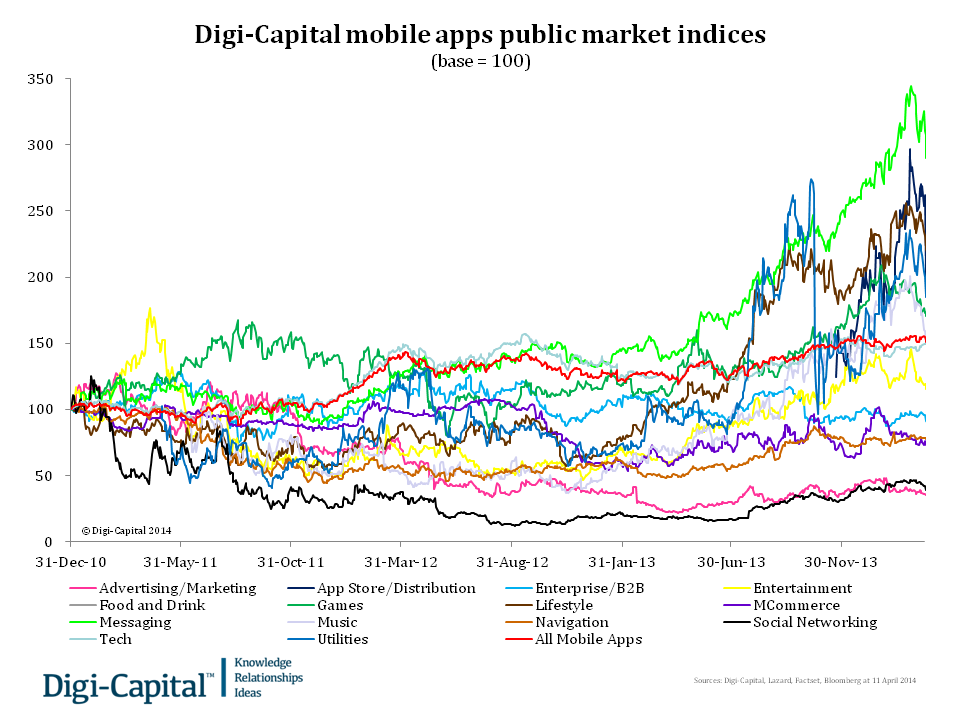

The Digi-Capital mobile apps public company index has grown in value, although

there have been significant differences in performance across app categories.

Mobile app public and private valuations have also varied significantly

across categories, with some app types valued much higher than others relative

to their economic performance. For investors and acquirers, it appears that not

all apps are created equal.

Free downloads and in-app purchases are dominating revenue (>90%), but

not for all app categories. In-app purchases have monetized most effectively

for mobile games (40% downloads = 74% revenue share), where the user gets most

of their fun from standalone apps on mobile devices with limited cloud

functionality. In-app purchases for all other app categories have monetized 4x

less effectively (60% downloads = 26% revenue share), including those apps

which leverage the cloud to give users what they want. We’re seeing the SaaS

model being adapted to operate as App as a Service, which looks like one way

that a range of app categories can lift their monetization to levels matching their

downloads and usage.

While it’s still early days, App as a Service models could change the

landscape for how apps make money in future.

As everyone knows, the highest grossing apps outperform all others

against key metrics. Digging into the data to compare the top 1% grossing apps

to other apps, the focus and level of performance required looks pretty clear.

The apps market is also creating billion dollar companies at what looks

like an accelerating pace globally, and we expect to see as many Asian as

Western companies delivering outsize returns for entrepreneurs and investors.

With such massive value being built so quickly, today’s growth companies

could become tomorrow’s consolidators. Many of the recent blockbuster

acquisitions by incumbents have been focused on strategic growth, but we’re

also seeing defensive moves to ward off potential threats.

In what is still an early stage market, we think now is the time for

mobile apps companies to either invest all out for growth, or position

themselves to be bought.”

Tim Merel will be presenting the

highlights of the Mobile Apps Investment Review at GMIC Beijing on 5th

and 6th of May.

About

Digi-Capital: Digi-Capital (www.digi-capital.com) is an investment bank for apps and games

focused across America, Asia (China, Japan, South Korea) and Europe.

Disclaimer: This document has been produced by Digi-Capital Limited and is furnished to you solely for your information and may not be reproduced or redistributed, in whole or in part, to any other person. No representation or warranty (expressed or implied) is made as to, and no reliance should be placed on, the fairness, accuracy or completeness of the information contained herein and, accordingly, Digi-Capital Limited does not accept any liability whatsoever arising directly or indirectly from the use of this document. In particular, the inclusion of any financial projections are presented solely for illustrative purposes and do not constitute a forecast. The recipient should independently review the underlying assumptions of the financial projections. This document is intended for initial contact with individuals and entities known to Digi-Capital Limited. This document is intended for use by the individual to whom it is sent, it is confidential and may not be reproduced in any form, further distributed to any other person, passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose without the prior written consent of Digi-Capital Limited. In the event that you are not the recipient indicated and you have inadvertently received this document, please delete it immediately. This document does not constitute or form part of, and should not be construed as, an offer, solicitation or invitation to purchase, subscribe for, or otherwise acquire any securities nor shall it or any part of it nor the fact of its distribution form the basis of or be relied upon in connection with any contract or commitment whatsoever. Any investment decision should be made solely on final documentation, and then only after review of the diligence materials and consideration of all relevant risks. Digi-Capital Limited does not have any responsibility for the information contained herein and does not make any representations or warranties, express or implied, as to the adequacy, accuracy or completeness of any statements, estimates or other information contained in this document. The information contained herein, while obtained from sources believed to be reliable, is not guaranteed as to its accuracy or completeness. This document may include forward-looking statements, including, but not limited to, statements as to future operating results and potential acquisitions and contracts. Forward-looking statements are sometimes, but not always, identified by their use of a date in the future or such words as “anticipates”, “aims”, “could”, “may”, “should”, “expects”, “believes”, “intends”, “plans” or “targets”. By their nature, forward-looking statements are inherently predictive, speculative and involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements. No assurances can be given that the forward-looking statements in this document will be realised. Digi-Capital Limited does not intend to update these forward-looking statements. No securities regulatory authority has approved or expressed an opinion about Digi-Capital Limited’s business prospects or any related securities. Any such securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "Securities Act"), or any other state or federal securities laws and may not be offered or sold in the United States of America absent registration under the Securities Act or an exemption from the registration requirements thereof. Digi-Capital Limited and any entity referred to in this document have not and will not be registered under the United States Securities Exchange Act of 1934, as amended or the US Investment Company Act of 1940, as amended, and any related securities may not be offered or sold or otherwise transferred within the United States or to, or for the account or benefit of, U.S. persons except under circumstances which will not require Digi-Capital Limited or any associated entity to register in the United States in accordance with the foregoing laws or any other law. Digi-Capital Limited is authorised and regulated by the Financial Services Authority. Digi-Capital Limited is the copyright owner of this document and does not grant you any licence to copy, adapt or distribute it, in whole or in part, without Digi-Capital Limited’s written permission to do so.